Going long-term in a volatile market – and vice versa

Should You Buy Crypto When the Market Is Down? A Guide to Navigating Market Dips

If you are new to crypto or coming into crypto from traditional trading or investment, it can be scary looking at the price charts jumping around all the time. No one would blame you for asking “Why should I invest in this?”

It may not seem promising at that point and it may seem like your investment will depreciate again in the very near future. You want to find the best time to buy cryptocurrency.

The first thing you need to ask yourself is: “Why am I investing in cryptocurrency?”

Are you looking to get rich overnight riding the volatility? Are you intrigued by the promise of a crypto future? Are you attracted to a particular crypto coin project for its features and applications?

These are all valid perspectives and there may not even be just one answer for you. Either way, investing in crypto comes down to two general approaches. Ride The Wave or Hold On for Dear Life.

Long Term Investment Or How I Learned To Stop Worrying And Love The Bomb

If you believe in a cashless society free from the meddling of those who would print you out of your future, then you are pretty much already there. You are looking at sitting on your investments for 5, 10, or even more years, knowing that in the end, you will achieve your goals.

Still, it’s not the same whether you buy a coin at $100 or $1000. All those returns are looking even better if you catch just the right moment and just the right coin. The answer to “should you buy crypto when the market is down?” is therefore always – yes.

You need to be looking at top crypto projects, but probably not the most famous ones. Sure, Bitcoin may hit $100k by the end of this or next year, but given the current price and how much it has already grown, you are looking at 3x or 5x return at best.

If all you are wondering about so far is: “should I buy bitcoin when it’s low or high?”, then here is some good news for you. It almost doesn’t matter, provided you are willing to sit on it for a while.

There is nothing wrong with going for Bitcoin or Etherium as part of your wallet, but that’s not the stuff that will make you really happy. You want to be the guy who invested in Bitcoin 10 years ago.

Learn about various projects and see what their endorsement rate is. Consider their applications. Is it just a Store of Value coin? Is it a Stablecoin? Does its blockchain tech have applications in security or transactions?

So pick your poison, or pick several and Hold On for Dear Life. Place your investment and throw away the key – at least for a few years. Remember, always invest in crypto only the amount of money you can afford to lose. If you tie up 100% of your net worth to, say, Bitcoin, then a drop of even just 20% is absolutely killing your net worth.

But you may be missing out still, so when you feel ready for the next step…

Day Trading

Maybe you’ve dabbled in crypto for a while. Maybe you have some experience trading stocks. All the things above still apply to you. Over time, your value will grow. But you want to take matters into your own hands and ride every single uptick and glide down to the value dip for more.

Maxing out all the opportunities is very appealing, but much riskier. You can find yourself on the wrong slope of a price chart line and end up losing your whole year’s gains.

In the end, unless you make some very big mistakes, you would still end up roughly the same as HODLers, but thankfully, there are strategies you can adopt to secure your net worth.

Dollar-Cost Averaging

DCA is a long-term strategy and it’s a little more hands-on than just dropping it all into a coin at one point. The thinking behind it is sound. Say you would be willing to part with $1200. Instead of buying $1200 worth of a coin immediately, you set aside about $100 every month.

By the end of the year, you will have invested the same amount of money but the regular intervals would average the costs and save you from sudden shifts in price.

However, for most coins, there’s just no telling when they will bounce back or when a price hike will settle down. It could last for months, meaning a few of your investment cycles could have been spent more wisely. It might be a good transitional strategy as you are getting used to the crypto environment, but there are better ones awaiting.

Technical Analysis

If you are coming into crypto from trading stocks then you know where this is going. The investors using technical analysis look at stocks based on their “fundamentals”. These tend to be revenue, valuation, or industry trends and they aren’t always reflected in the market price.

The market isn’t an all-knowing, all-wise agent and stock bubbles are sadly still a thing.

The problem with applying technical analysis to crypto is determining what these fundamentals are. We’ve mentioned the various applications of coins and their use cases already. Next, consider the recent news and developments. How do those map onto the crypto coin’s value?

Are the developments going to lead to more use-cases and greater adoption rate or is the price trend a swan song?

Always keep in mind that influencers and talking heads can have a vested interest in a coin’s success or failure. They may be looking to recoup their own losses by keeping the hype going unreasonably long. Filter out the baseless hype.

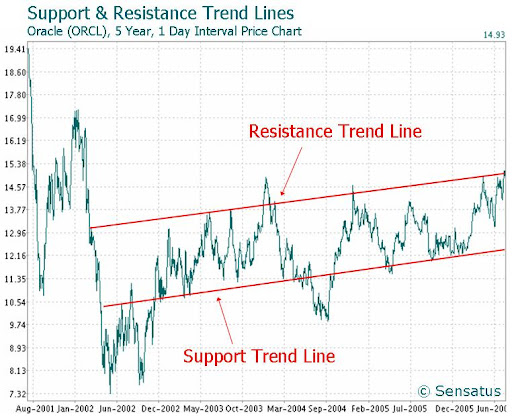

More often than not, taking a cold, hard look at a coin will do you more good than having an ear to the ground and listening to all the noise. Consider the example of Oracle’s 1 Day price chart over 5 years.

It’s a stock example, sure, but the principle holds. You will want to apply this and similar analysis tools to predict likely dips and know with near-certainty when to buy crypto.

Can’t I Just Follow Some General Rules?

Sure. There are some general tips you could follow and be well on your way to trading. We’ve mentioned the very basic “buy the dip” and the advanced technical analysis. Other rules have emerged as a result of trading trends and give us a clue on when is the best time to buy cryptocurrency.

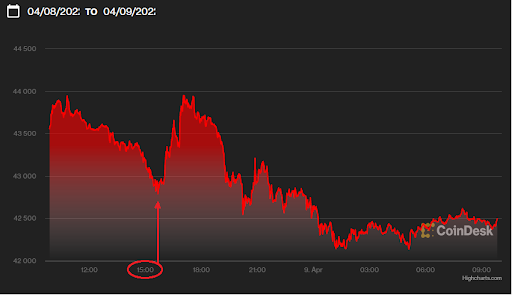

Time Of Day

The best hours in the past years have tended to be in the afternoon, around 2-5 pm GMT, and then again later in the evening, but this is less predictable so use it more as a pointer.

Time Of Week

According to research by two economists, the best time to buy Bitcoin and Ethereum is Tuesday or Thursday. Other crypto coins tend to follow the trend of these giants, so you’d be making a correct assumption most of the time.

Conclusion

While cryptocurrencies have rallied back in the past, following major declines, there is no guarantee it will happen again. It’s an experimental environment after all. Invest responsibly and take it slow.

Get into more complex and hands-on trading approaches and strategies as you grow comfortable with crypto to really make the best use of every dip. Even if you have some experience with stocks, keep in mind that crypto is significantly different so be humble and take your own assumptions with a grain of salt. Good luck out there!